If you're an online retailer, offering installment plans can significantly boost customer satisfaction and sales. And if you're looking for a flexible payment solution that lets consumers split purchases into manageable, interest-free installments, Splitit might just be the perfect fit for your business.

In this review, we’ll dive deep into the ins and outs of Splitit—its key features, how it works, and what makes it stand out in the world of Buy Now, Pay Later (BNPL) solutions. Keep reading and learn everything you need to know about Splitit.

What is Splitit?

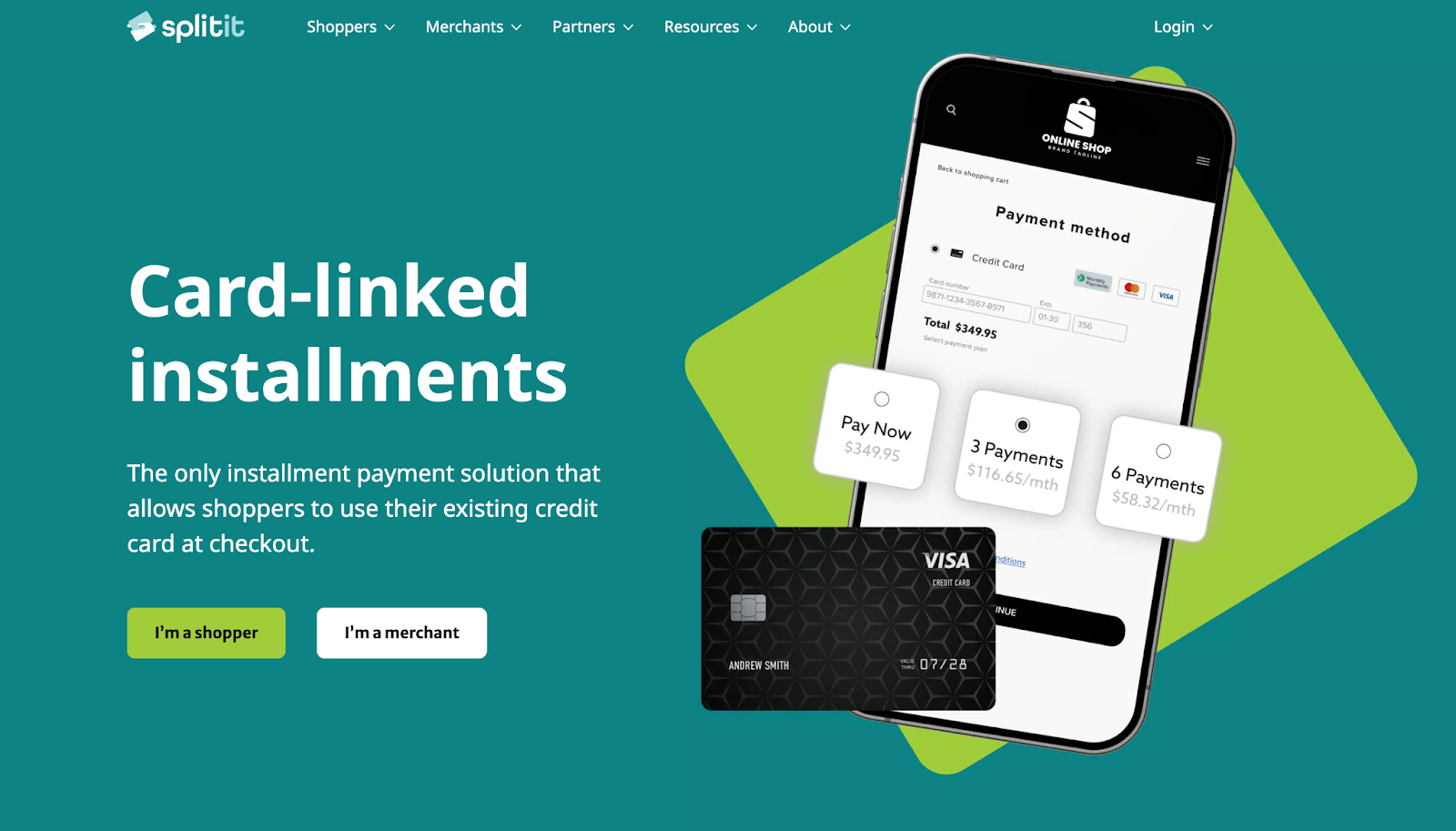

Splitit is a Buy Now, Pay Later (BNPL) solution that allows consumers to make purchases using their existing credit card, but split the cost into interest-free installments. Unlike traditional BNPL programs that require new credit lines or accounts, Splitit uses available credit on a customer’s card without charging interest, as long as they make monthly payments.

The service works directly with sellers to offer this option at checkout, giving shoppers the flexibility to pay in installments while the merchant receives the full payment upfront. It’s a model that makes Splitit attractive to people who want installment payments without applying for new financing or incurring interest fees.

Who uses Splitit?

Splitit appeals to businesses and merchants aiming to increase conversion rates on higher-priced items, consumers seeking payment flexibility, and overall credit card holders who don’t want to pay interest on their purchases. It’s a service that offers distinct benefits to these groups:

Businesses and merchants

To increase sales, businesses selling higher-priced items often use Splitit to offer options for payment flexibility. These retailers often work in sectors such as luxury goods, jewelry, travel, healthcare, home appliances, and furniture.

Businesses and merchants partner with Splitit to offer installment payments at checkout, allowing them to attract more customers. This process helps the business's products seem more affordable and accessible, easing consumer hesitation over high upfront costs. Splitit handles the installment process with the consumer’s card issuer.

Consumers

Splitit is beneficial for shoppers who prefer flexibility in paying for products without taking on new debt. They often use Splitit to break down the cost of high-ticket items into smaller, manageable monthly payments while still using their existing credit cards. This allows them to avoid interest charges and additional credit checks, which is appealing to those who are budget-conscious or simply may not have the cash available on hand.

That being said, Splitit is often used for purchases in categories with high-value products, or for big purchases of many products—anything that benefits from being split into payments.

What you need to know about Splitit

Splitit is an interest-free, no-credit-check payment solution for consumers and a risk-free way for sellers to offer flexible payment options. Even so, when thinking about using the service, it’s important to know:

How Splitit works

Splitit allows consumers to divide the cost of purchases into interest-free monthly payments using their existing credit cards. Unlike traditional financing or BNPL services, Splitit doesn’t issue loans. Instead, it holds the total purchase amount on the customer’s credit card and releases portions as each installment is paid.

When a sale is made with Splitit, the total purchase price is divided into equal monthly installments and charged automatically each month.

What Splitit costs

For consumers, there are no interest or additional fees for using Splitit, as long as they make their payments on time, in which case the terms and conditions outlined by their credit card provider will be applied.

As for businesses, fees can vary by up to 6.5% per transaction, plus a flat fee. The costs will depend on whether the retailer wants the entire payment upfront or not.

Which businesses Splitit won’t work with

The service has a strict list of companies that are considered prohibited from adopting Splitit's payment solutions. Some of the services and business models not allowed to use Splitit are:

- Companies selling adult entertainment products

- Businesses selling counterfeit goods

- The selling or manufacturing of firearms and ammunition

- Businesses involved with gambling

- Magazine subscriptions

- Pseudo-pharmaceuticals and other products with health claims not approved/verified

- Online auctions

- Pay-per-click and parked websites

- Payroll companies

- Precious metal sales

- Real estate brokers

- Search engine optimization (SEO) services

- Social networking sites

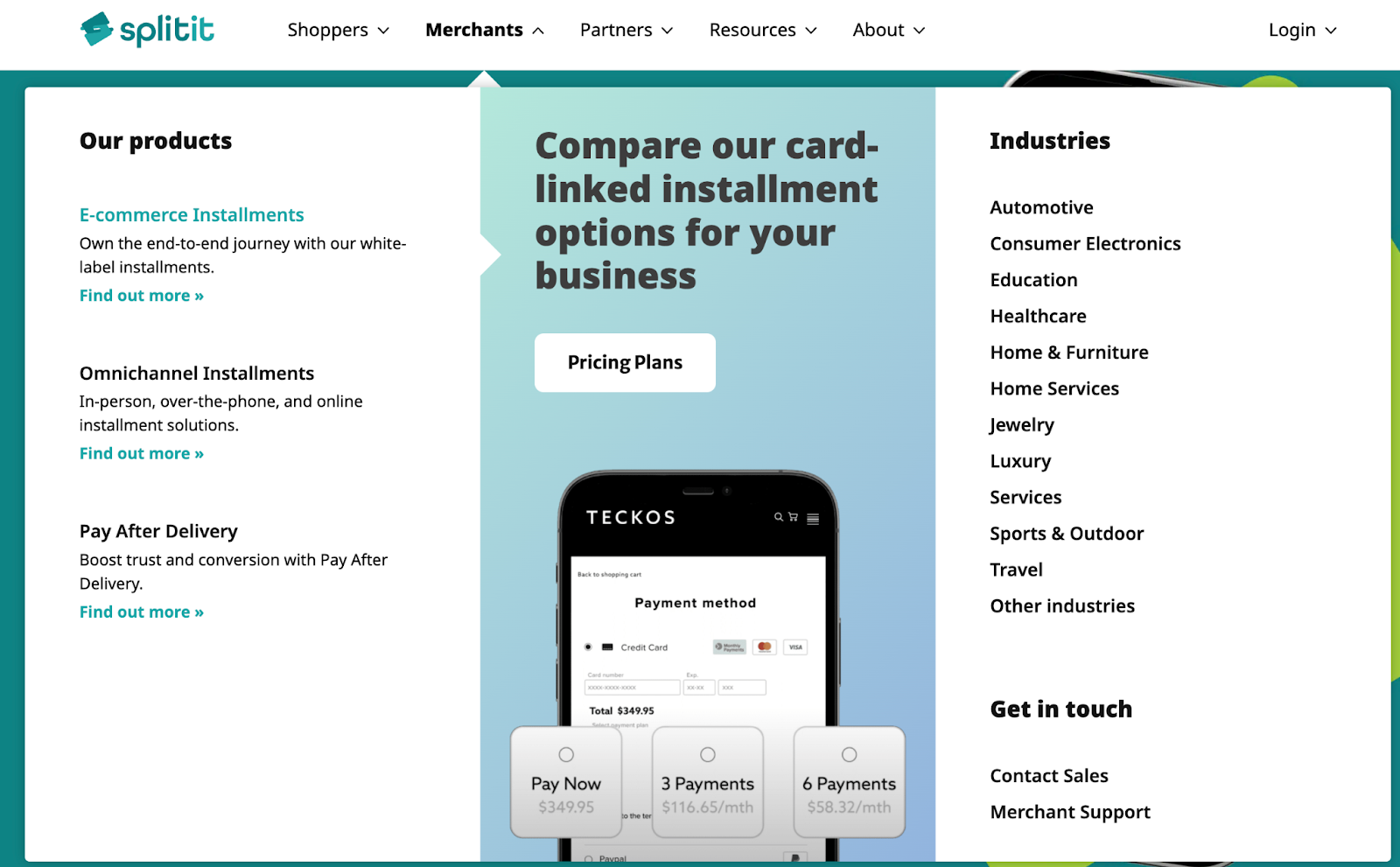

Splitit key features

For buyers, Splitit offers a more affordable solution for buying expensive products. For sellers, on the other hand, the service offers some key features for businesses:

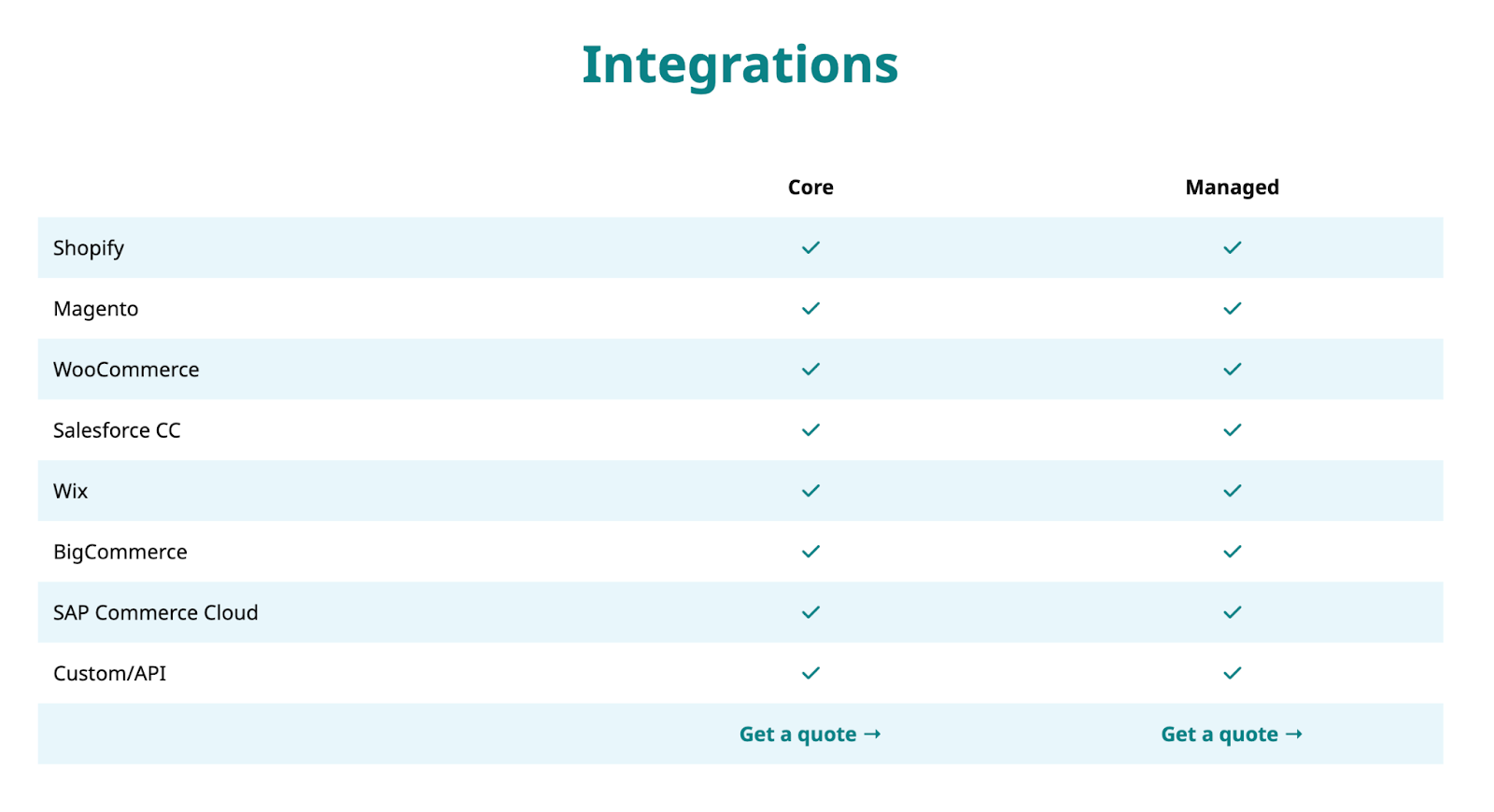

Ecommerce platforms integrations

Splitit is designed to integrate with major ecommerce platforms. This provides a flexible experience for buyers and sellers, supporting custom integration if needed.

The ecommerce platform partners include:

- Shopify

- WooCommerce

- BigCommerce

- Magento

- Wix

- Salesforce CC

- SAP Commerce Cloud

Installments

Splitit offers consumers the ability to divide the cost of online purchases into interest-free monthly installments at the checkout. This feature caters to ecommerce businesses, providing a smooth, flexible payment experience for online shoppers.

Sellers can offer installment payments without redirecting the customer to third-party platforms, improving retention and checkout conversions.

Omnichannel installments

The service also provides installment payment options across multiple sales channels, including online stores, mobile apps, and in-store purchases. With this feature, businesses can provide a consistent experience, whether the customer is shopping online or in a physical store.

Pay after delivery

Splitit allows customers to pay for goods after they’ve received them. The full amount is placed on hold, and customers can break their payments into installments once the product has been delivered.

This option provides a higher level of trust for consumers, as they only start paying after confirming they’ve received the item. The good part is that sellers still receive the full payment upfront (the next subject on this list), while consumers enjoy the benefit of not paying until delivery, reducing buyer friction.

Guaranteed full transaction amount

With Splitit, sellers receive the full transaction amount immediately, regardless of the consumer’s installment payment schedule. Splitit handles the collection of the installments directly from the customer’s credit card.

Global payment acceptance

Splitit supports transactions across multiple countries and currencies, making it a versatile option for ecommerce businesses that want to tap into new markets.

Automated reconciliation

This feature simplifies accounting and financial management by automatically reconciling customer payments with the business’s records. This reduces the administrative burden, especially in companies handling high transaction volumes.

Fraud detection and prevention

Splitit uses industry-standard security practices to minimize the risk of fraudulent activity, ensuring that businesses can offer installment payments with maximum security.

Pros and cons of Splitit

Despite being a solution that offers several benefits for both consumers and businesses, Splitit also has a series of disadvantages that should be considered by those planning to use the service.

Pros of Splitit

Here are some of the main benefits of Splitit:

Interest-free installments

As mentioned before, consumers can split their payments over several months without paying interest. As long as the consumer makes the required payments on time and maintains enough available credit, they’ll avoid additional fees or interest.

No credit check required

Splitit doesn’t require a credit check, making it accessible to a wider audience. Consumers don’t have to worry about applying for new loans or lines of credit. Since it uses the credit already available on existing cards, there’s no impact on credit scores, and users can take advantage of the service immediately without approval delays.

No fees for consumers

Unlike some Buy Now, Pay Later services, Splitit doesn’t charge consumers fees for using the service. As long as the payments are made, there are no hidden fees. This makes Splitit an attractive option for shoppers, as they don’t have to worry about extra costs piling up.

Increased conversion rates for merchants

Offering installment payments can help increase conversion rates, reduce cart abandonment, and boost average order value (AOV) because consumers are more likely to make larger purchases when they can pay over time. Using Splitit often improves sales metrics as well, especially for high-ticket items where upfront costs can deter purchases.

No late fees

Splitit doesn’t charge late fees if a payment is missed, as long as the card continues to have available credit for future installments. This reduces the financial burden on consumers and provides more flexibility, unlike services that penalize late payments with heavy fees.

Cons of Splitit

Considering some aspects of the service, Splitit has its fair share of disadvantages as well, like:

It requires full available credit

Splitit requires the full purchase amount to be available on the customer’s credit card, even if they’re only paying in installments. This can be a limitation for consumers with limited available credit. The card is essentially "reserved" for the full amount until the balance is paid off, reducing flexibility for other purchases on that card.

Limited credit card options

Splitit installment plans can only be paid with Visa and Mastercard credit cards. American Express or Discover can be used in some cases depending on the merchant.

Relies on credit card limits

The buyer’s ability to use Splitit depends on their existing credit card limit, which could be a barrier for those with low credit limits or those who have already used a significant portion of their available credit. If a consumer’s card is maxed out or near its limit, they won’t be able to use Splitit, even if they want to break a purchase into installments.

It’s not actually available everywhere

While Splitit is available globally, it’s not accepted by all merchants. Smaller or niche retailers who offer less expensive products might not offer it as a payment option, opting for BNPL platforms with bigger reach. Its restricted list of business types that cannot use Splitit also means that many companies cannot use the service.

No rewards or cashback incentives

Splitit doesn’t offer any rewards, cashback, or loyalty incentives for using the service. This could make it less appealing for consumers who are accustomed to rewards programs, especially if they are comparing Splitit to other BNPL services or credit cards that offer perks for purchases.

Boost your sales with Whop's payment methods

It's safe to say that Splitit offers many advantages for entrepreneurs when it comes to payment methods. However, with Whop Payments, you get these options (BNPL included) integrated into a complete sales platform with everything you need to run your online business; it doesn't matter if you're selling coaching and ebooks, creating courses, or offering paid communities.

Whether you’re a beginner entrepreneur or the owner of a large company, Whop truly is an all-in-one platform that has everything you need. You can become an expert in ecommerce or sell your knowledge to your own private community.

Credit cards, Google Pay, Apple Pay, and cryptocurrency are some of the options Whop Payments uses to provide you and your consumers the best experience when doing business. It only takes a few minutes to join, so start selling with Whop.

Splitit review FAQs

The frequently asked questions about Splitit.

How does Splitit benefit my business?

Splitit can increase your sales by offering customers a way to split their payments into manageable, interest-free installments. This makes higher-ticket items more accessible and can reduce cart abandonment, helping you convert more visitors into paying customers. Additionally, you’ll receive the full payment upfront while Splitit handles the installments.

Is there any financial risk for using Splitit?

No, there’s no financial risk for sellers. You receive the full payment at the time of the transaction, even though the customer is paying in installments. Splitit uses the customer’s existing credit card limit to secure the payments, meaning there’s no risk of default for you.

Can I use Splitit for both online and in-store sales?

Yes, Splitit offers omnichannel capabilities, allowing you to integrate installment payments across your online store, mobile app, and physical locations. This provides a seamless experience for your customers, no matter how they choose to shop with you.

Why you should trust us

A senior content writer at Whop, Joe Niehaus brings years of expertise in ecommerce business solutions. His knowledge has also been highlighted in renowned outlets such as Business Insider, GQ, and Travel + Leisure, where he’s contributed insights on online business and affiliate marketing, among other subjects on the ecommerce industry.